Expenses that reduce the amount of tax on simplified taxation system income

There are expenses that reduce the amount of the simplified tax system tax (Article 346.21 of the Tax Code of the Russian Federation). These are payments related to:

- to compulsory health insurance;

- pension provision;

- temporary disability insurance, with the exception of contributions for injuries and maternity benefits;

- sickness benefits (only the first 3 days of sick leave);

- expenses for voluntary health insurance (subject to compliance with the norms of subclause 3, clause 3.1, article 346.21 of the Tax Code of the Russian Federation).

Insurance premiums are paid by legal entities and individual entrepreneurs on almost all payments to employees. And individual entrepreneurs without employees pay contributions (with the exception of contributions to the Social Insurance Fund) only for themselves and in a fixed amount.

IMPORTANT! Individual entrepreneurs pay contributions to the Social Insurance Fund for themselves on a voluntary basis.

If the simplifier also pays a trade tax, then its amount is also deducted from the tax. In this case, the part of the tax that relates specifically to the simplified tax system is subject to reduction.

We reduce the “profitable” simplified tax system for insurance premiums correctly

Tax on simplified taxation system income can be reduced by insurance premiums paid in the period for which this tax is calculated (and even by those insurance premiums paid for past periods).

Let's explain with examples:

Example 1

In the 1st quarter of 2017, insurance premiums were charged in the amount of RUB 20,000. And they paid for them in the same quarter for 5,000 rubles. more (for payments for the 2nd quarter) - 25,000 rubles. To reduce the simplified tax system you can put only 20,000 rubles, and 5,000 rubles. We will take it into account when calculating tax for the six months.

Example 2

In the 1st quarter of 2017, accrued insurance premiums amounted to 10,000 rubles, and paid premiums amounted to 12,000 rubles, of which 2,000 rubles. — arrears for the 4th quarter of 2016. The entire amount of 12,000 rubles can be deducted for the 1st quarter of 2017.

IMPORTANT! Don’t forget the rule: we reduce the simplified tax system of 6% for those insurance premiums that relate to a simplified type of activity. If it is not possible to determine which contributions relate to the simplified tax system, they should be distributed in proportion to the income received from different types of activities.

Example 3

The total amount of income of the individual entrepreneur was 100,000 rubles, of which, according to the simplified tax system 6% - 40,000 rubles, and 60,000 rubles. received according to UTII. The amount of contributions allowed for deduction is RUB 5,000. It is not possible to distribute the paid contributions between the applied regimes.

For deduction under the simplified tax system you can take:

Don't know your rights?

5 × 40 / 100 = 2,000 rub.

What determines what amounts reduce the “income” tax?

When the question arises of which contributions reduce the simplified tax system tax at 6%, you need to figure out who will make the deduction.

If this is a legal entity or individual entrepreneur with employees, then the total amount of all expenses allowed for deduction cannot be more than 50% of the simplified tax system. The same applies to fixed payments of individual entrepreneurs for themselves.

Example 4

The amount of calculated tax for the 1st quarter of 2017 is 1,780 rubles, and the paid contributions are 2,300 rubles. Then the following amount should be added to the reduction for the quarter:

1780 × 50% = 890 rub.

And the budget should pay:

780 − 890 = 890 rub.

When an individual entrepreneur works alone, he has the right to apply the entire amount of fixed contributions to the deduction.

Example 5

The amount of the calculated simplified tax system for individual entrepreneurs without employees for 2017 is 8,900 rubles, and the amount of payments to the Pension Fund and the Compulsory Medical Insurance Fund is 5,600 rubles.

Then the following must be paid:

8900 − 5600 = 3300 rub.

But if the amount of tax is less than the amount of contributions paid, for example, 5,000 rubles, and the contributions are 5,600 rubles, then the amount of contributions equal to the tax (5,000 rubles) will be reduced, and you do not need to pay anything to the budget.

Expenses for which it is allowed to reduce tax on the “income” simplification are given in Art. 346.21 Tax Code of the Russian Federation. In this case, it is necessary to take into account who applies the simplified special regime and what amounts of expenses allowed for reduction were paid in the period for which the simplified tax system is calculated.

“Simplified” is a favorable taxation system. Final reporting instead of quarterly, savings on contributions to the Federal Tax Service with a well-chosen object of taxation - all this reduces the tax pressure placed on entrepreneurs. But there is one more plus - the ability to deduct already paid contributions from the amount calculated for payment to the Federal Tax Service and significantly reduce costs. Therefore, we will consider such a pressing topic as reducing the simplified tax system tax on the amount of insurance premiums in 2019 for individual entrepreneurs.

Reducing the tax duty on the “simplified” system – important conditions

The most important thing that all “simplified” entrepreneurs should know is that the tax duty can be reduced only on those transfers to state funds that were paid in the billing period.

That is, the down payment can be reduced only if the following two indicators coincide:

- The period for which the payment is made is the first 3 months, 6, 9 and 12 months. Let's imagine that this is the first half of the year.

- The period in which deductions have already been made, regardless of whether they were paid for this period or even for a long time. In the above case, they must be paid by June 30.

Another example: if the payment to the Pension Fund was paid before March 30 (the end of the first quarter), then all 4 payments can be reduced by the payment amount. Since this date is included in the quarter, and in the first half of the year, and in 9 months, and in 12 months.

Conclusion: it is advisable to make contributions every quarter in order to save on payments for each period. Or pay all due fees at the end of the first three months.

The types of transfers to the budget, the amount of which can be deducted from simplified payments, depend on the type of company - with or without employees. And the principle by which deductions are made depends on the type of object chosen. With an object of 6%, the tax duty is minimized by deducting pension contributions, income/expenses - by entering them in the expenses column.

How to reduce the tax on insurance premiums for individual entrepreneurs using the simplified tax system 6% without employees

Let’s immediately consider the first and most important question: can an individual entrepreneur reduce the tax under the simplified tax system on fixed contributions.

All rights and obligations of a simplified taxpayer are regulated by Article 346.21. It contains clause 3.1., according to which individual business entities whose activities did not require the involvement of hired workers and are subject to 6% tax on the object can reduce the tax duty by the amount of fixed fees paid.

There are no restrictions on deductions. That is, a tax reduction on the amount of contributions to the Pension Fund for individual entrepreneurs is possible by 100%, even if there are 0 rubles left to be paid.

A tax reduction for individual entrepreneurs on the simplified tax system of 6 percent without employees in 2019 is possible for the amount of payments:

- In PF contributed for oneself in the minimum established amount;

- To the medical fund insurance, also paid in a minimum amount;

- Contributed to the pension fund in the amount of 1% from profits over 300 thousand rubles.

Other types of payments, for example, for insurance on a voluntary basis, are not taken into account.

An example of calculating quarterly payments for a tax type of 6% without staff

For the convenience of calculating advances for simplified taxation at six percent, you can use the following formula:

(Income) x 6% – (Transfers to the Pension Fund) – (Advances made)

Let's consider in practice how to apply a reduction in the tax on insurance premiums for individual entrepreneurs without employees on the simplified tax system for income of 6% in 2019 in payment calculations, presenting all the initial data in the table:

Let's calculate how much money you need to prepare for payment:

- First quarter = 30,000 x 0.06 – 6,997 = -5,197. No need to pay.

- Half year = 140,000 x 0.06 – (6,997 + 6,997) = -5554. Again, there is no need to make an advance payment.

- 9 months = 450,000 x 0.06 – (6,997 + 6,997 + 11,497) = 1,509 rubles. need to pay.

- 12 months = 650,000 x 0.06 – (6,997 x 2 + 10,497 + 11,497) – 1,509 = 1,503 rubles. need to pay.

By paying pension and other funds quarterly, an entrepreneur can save a lot of money, since the advance payment can be reduced by up to 100%. In some periods, it may be possible to completely avoid the need to make an advance payment to the Federal Tax Service.

If the advance calculated using the above formula decreases to minus, the funds will not be returned to the entrepreneur. For example, if it turns out to be -5999, the taxpayer will not receive these 5999.

How to reduce the tax on insurance premiums for individual entrepreneurs using the simplified tax system 6% with employees

If a businessman employs employees, a completely different rule comes into force - contributions to the Federal Tax Service can be reduced by funds contributed to the Pension Fund for employees, although by no more than 50% of the amount payable.

Can a businessman reduce tax on the amount of his contributions? Yes, if the reduction is less than half of the original figure.

A businessman is not required to contribute funds for himself to the Social Insurance Fund. Therefore, even if he registers with the FFS, the tax burden will not be reduced. Voluntary fees will not be deducted.

A reduction in the tax on insurance premiums for individual entrepreneurs with employees using the simplified tax system for income of 6 percent in 2019 is possible for the amount of payments:

- Fixed for yourself;

- Insurance for hired employees;

- Sick leave for the first 3 days, which is paid by the employer from its budget;

- Voluntary insurance for employees in case of loss of ability to work.

- You can also reduce the tax under the simplified tax system for individual entrepreneurs with income over 300,000 for contributions to the Pension Fund of 1%.

The rates for contributions to budgetary or extra-budgetary funds operating in Russia in 2019 remained the same as in 2018. They can be found in the Tax Code of the Russian Federation or from any tax authority.

Example of tax calculation for the 6% tax type with employees

The formula for calculating the duty payable for the reporting period can be presented as follows:

(Profit) x (6%) – (Deductions) – (Advance duties already paid)

But payment cannot be charged less than the following amount:

(Profit) x 6% x 50%

For example, a company operates in Moscow on a “simplified” basis with a rate of 6% and has a small staff. The head of the company contributes funds to the pension fund quarterly. Let's present all the initial data in the table:

We calculate how much you need to pay:

- Quarter = 20,000 – 11,000 = 9,000.

- Half a year = 35,000 – 22,000 – 9,000 = 4,000. But this is more than 50%, so the payment is 35,000 x 0.5 = 17,500.

- 3 quarters = 60,000 – 36,900 – 26,500 = -3,400. We recalculate again: 60,000 x 0.5 = 30,000.

- Year = 240,000 – 53,600 – 56,500 = 129,900. This is more than 50% of 240,000 rubles, so we take for payment as much as we counted.

Rules for reducing tax duty under “simplified terms” for enterprises with profits over 300 thousand.

A businessman whose profit exceeds the maximum allowable limit of 300,000 must contribute 1% of the excess profit to the Pension Fund. That is, if the profit was 448,500, then the businessman additionally contributes 1,485 to the Pension Fund (448,500 - 300,000 x 1%).

According to the law of July 4, 2009, both fixed contributions to the funds and those calculated from profits over 300,000 are fixed. Does the tax for individual entrepreneurs on the simplified tax system paid to the Pension Fund reduce 1% on income over 300,000 rubles in 2019? Yes, since the taxpayer has the right to reduce it by fixed amounts.

Calculation example: how to deduct 1% from excess income

Let's look at the example of reducing the simplified tax system by the amount of insurance premiums in 2019 for individual entrepreneurs who paid 1 percent of income to the Pension Fund.

Let us take the following conditions for calculations:

- In the first 90 days, the income capital amounted to 200,000, 6,997 rubles were paid to the Pension Fund.

- For 6 months of activity, an individual entrepreneur earned a profit of 340,000, which is more than the minimum 300,000. Therefore, he additionally contributed 400 to the Pension Fund (40,000 x 1%). Payments amounted to 6,997. Total paid = 6,997 + 400 = 7,397.

Let's consider how the advance will be calculated for these 2 terms:

- 200,000 x 0.06 – 6,997 = 5,003 payable;

- 340,000 x 0.06 – 5,003 – 10,997 = 4,400 payable.

Controversial situations and nuances

When calculating an advance payment, entrepreneurs may encounter a number of questions, so let’s look at some of the nuances of reducing the duty in more detail:

| Question | Answer |

|---|---|

| Can an individual entrepreneur reduce tax under the simplified tax system by the amount of insurance premiums for himself or his employees paid in previous years? | Yes, because only the date of actual payment is important. |

| The taxpayer hired one person in the middle of the reporting year. How will the payment procedure change? | As soon as the entrepreneur makes the payment to the individual. person, he will be considered an employer. The right to reduce the duty by more than 50% will be lost from now until the end of the year. |

| The taxpayer fired his entire staff, when will he be able to switch to deducting insurance payments at 100%? | Only from the new tax year. |

| Is it permissible to deduct funds contributed to the budget for a long-ago year if a businessman switched to “simplified” only in this year? | Yes, only the period within which the payment was made is important. |

| Is it possible to reduce the tax on insurance premiums for individual entrepreneurs using the simplified tax system for income by 100% if the company has only one employee who is on maternity leave? | Yes, since a businessman can be an employer only when making actual payments to individuals. persons. The presence of employees, regardless of their number, does not serve as a reason for refusing to use 100% deductions. |

"Income minus expenses"

Individuals engaged in individual entrepreneurship in the 15% regime save on deductions of payments in a completely different way. All insurance and pension payments for yourself and employees should be included in the expense column of the enterprise. Thanks to this, the amount of tax overpayments will be reduced, since the formula is used to calculate tax duties on a 15% object:

(Profit) – (Company costs)

Let us describe the last value of the formula in more detail:

(Company expenses) = (Business expenses) + (Deductions) + (1% of excess profit)

There are no percentage restrictions. You can include the entire amount paid into the funds into expenses. True, it must be paid in the period for which you want to reduce the advance. Therefore, it is better to pay insurance and pension contributions quarterly, as in the case of the previously discussed object.

Example of tax calculation at a rate of 15%

Let's look at the example of a decrease in contributions for oneself for an individual entrepreneur, income minus expenses. Let's take the following as initial data:

- The taxpayer began working at the facility at 15% and received an annual profit of RUB 578,000;

- Business expenses amounted to 248,000;

- Accrued to the pension fund - 21,345;

- Plus, the businessman paid 1% to the Pension Fund for excess income, the additional payment amounted to 2,780 rubles.

Due in 12 months. = (578,000 – 248,000 – 21,345 – 2,780) x 15% = 45,881 rub.

We can conclude: the 15% regime is beneficial for the founders of companies with a high level of expenses. For example, in this mode it is allowed to deduct the cost of goods purchased for resale.

It is also suitable for those whose project brings profit unevenly, since losses can also be included in expenses. Taxpayers on a 6% property do not have such a privilege; they must make contributions even if the profitability does not exceed 0.

The selected object of taxation on the simplified tax system affects the right of the simplified person to take into account his expenses when determining the tax base. But even with the object “income of 6%”, a simplifier can reduce his tax by a number of payments. We will tell you how to do this in our consultation.

simplified tax system "income"

A simplifier in KUDiR reflects his income from sales and non-operating income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation) using the “cash” method. What relates to income from sales can be read in Art. 249 Tax Code of the Russian Federation. The list of non-operating income is given in Art. 250 Tax Code of the Russian Federation. The “cash” method of recognizing the income of a simplifier means that his income is recognized on the date of receipt of funds and other property or repayment of debt in another way (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

- contributions paid from employee benefits to extra-budgetary funds;

- temporary disability benefits paid at the expense of the employer (except for industrial accidents and occupational diseases);

- payments for voluntary insurance of employees in case of their temporary disability under certain conditions.

In addition, the payer of the trade tax who is on the simplified tax system “income” can reduce his tax by it using a simplified tax system (clause 8 of article 346.21 of the Tax Code of the Russian Federation). The listed fee reduces only that part of the “simplified” tax, which is calculated for the activities subject to the trade fee.

Simplified tax system “income 6%”: reduction of tax on contributions

Contributions to extra-budgetary funds reduce tax under the simplified tax system under the following conditions:

- the contributions were actually paid in the reporting (tax) period in which the simplifier wants to reduce his tax;

- contributions have been paid within the calculated amounts. This means that it is impossible to reduce the tax on contributions that are transferred in excess of the accrued amounts, resulting in an overpayment of contributions. Overpaid contributions can be taken into account in the period in which a decision is made to offset these amounts against arrears of contributions. At the same time, payment of arrears in contributions that have arisen over previous years reduces the tax during the period of payment of contributions;

- Only those amounts of insurance premiums that were accrued during the period of application of the simplified tax system can be reduced. If a simplifier pays off debt on contributions that arose during the period of application, for example, of OSNO, it will not be possible to reduce the tax under the simplified tax system on them.

How much can you reduce tax under the simplified tax system?

Contributions to extra-budgetary funds of the simplifier, as well as other payments listed in clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation, they can reduce the tax of an organization under the simplified tax system or a simplified individual entrepreneur with employees by a maximum of 50%.

If a simplified individual entrepreneur does not have employees, then he can reduce his tax by the insurance premiums paid for himself without restrictions.

The amounts of contributions and other payments by which a simplifier reduces his tax on the simplified tax system will be reflected in the Tax Return under the simplified tax system in 2019 (approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/99@) on lines 140-143 Section 2.1.1.

“STS reduction for insurance premiums 2016”- such a search request can come from an entrepreneur or organization that uses a simplification. And this is not surprising, because calculus insurance premiums under the simplified tax system and their consideration when determining the tax base have their own characteristics, the key of which are given in this article.

Do simplifiers need to pay fees?

As you know, the state replenishes the treasury with insurance premiums for the following purposes:

- pension insurance (mandatory);

- mandatory provision of medical care;

- social insurance (for example, sick leave benefits or maternity pay, as well as payments in case of injury during the performance of work duties).

Payment of insurance premiums is the responsibility of:

- for organizations and individual entrepreneurs who make payments to individuals (both full-time employees and those working under a contract);

- for entrepreneurs, as well as persons engaged in legal and notary practice, without hired personnel, which does not relieve them of the obligation to pay fees for themselves.

This means that the obligation to calculate and pay insurance amounts extends to organizations and entrepreneurs who use the simplified tax system in their activities.

What are the features of calculating contributions for simplifiers?

For payers on simplified tax system insurance premiums in 2016 are calculated in the general manner, i.e. the base for calculation is payments in favor of the employees listed in Art. 7 of the Law “On Insurance Contributions...” dated July 24, 2009 No. 212-FZ.

However, for them there are certain advantages in terms of calculation, which include the possibility of using preferential rates introduced specifically for simplifiers. For example, the general tariff for paying insurance premiums to the Pension Fund is 22%, and for some simplifiers the rate is 20%. At the same time, in terms of the Social Insurance Fund and the Compulsory Medical Insurance Fund, rates are generally zero. That is, the total insurance rate for simplified beneficiaries is 20%. Compared to the regular tariff of 30%, this is a significant saving.

IMPORTANT! The preferential tariff schedule is given in Part 3.4 of Art. 58 of Law No. 212-FZ. To apply a reduced rate, the payer must provide the regulatory authorities with a document notifying the use of the simplified tax system and a document confirming the right to such a tariff.

However, preferential rates can only be applied by simplifiers who meet the requirements specified in the law. Such requirements include the following:

- If an entrepreneur combines taxation regimes (for example, imputation and simplified taxation), then it is important that the main share of revenue comes from activities under the simplified regime. In numbers, this ratio should be about 70% of total revenue.

- The law defines the types of activities within which reduced insurance premium rates can be applied. This includes, for example, the production of food and furniture, construction and tailoring services, some social services (educational, health care), the production of leather goods, and work with wood.

It should be remembered that simplifiers may lose the right to apply reduced tariffs. This occurs under the following circumstances:

- An organization or entrepreneur can no longer apply the simplified system due to non-compliance with restrictions (for example, the number of employees has exceeded the maximum permissible value).

- The actual activity no longer corresponds to the declared type of activity within which it is permissible to apply preferential rates.

NOTE! Is it necessary to consider underpaid amounts as arrears and accrue penalties if, by the end of the reporting period (year), the actual type of activity no longer corresponds to the declared one? This question is answered by letter from the Ministry of Labor of Russia dated July 5, 2013 No. 17-3/1084: the underpaid amount must be restored and transferred to the funds, but the amount should not be defined as arrears, and accordingly, there is no need to calculate penalties.

What are the features of reducing the simplified tax system on the amount of insurance premiums?

As mentioned above, subject to the described requirements for the payer to USN insurance premiums may be paid in accordance with the preferential tariff schedule. In addition, the legislation provides for another preference for business - an entrepreneur or organization can reduce their tax liability by the amount of insurance premiums paid (Chapter 26.2 of the Tax Code of the Russian Federation). Reducing the obligation occurs in different ways, depending on the type of simplification:

- when calculating tax on the “income” object, the amount of insurance premiums must be deducted directly from the tax;

- if the tax is calculated on the basis of “income minus expenses”, insurance premiums must be included in the expenditure portion when determining the taxable base.

When applying a system where only “income” is selected as the tax base, you need to remember the following features:

- The tax liability can be reduced only by insurance premiums for compulsory pensions, health insurance, social benefits for sick leave (temporary disability, maternity) and in case of injuries and illnesses associated with production activities.

- Insurance premiums must be paid in the reporting period for which the single tax was calculated. That is, if it is necessary to pay the advance portion of the single tax for the 1st quarter, then it is impossible to reduce the tax by the amount of insurance premiums paid in April, although accrued for March. This part of the contributions will go towards reducing the advance payment for the six months.

- The tax cannot be reduced by the amount of overpayments when fulfilling obligations to pay insurance premiums.

- The tax can be reduced only by the amount of insurance premiums calculated during the use of the simplified tax system. For example: an organization switched to the simplified tax system in January 2016 and in January paid insurance premiums from payments accrued for December 2015, i.e., while still on the simplified tax system. In this case, the single tax cannot be reduced by the amount of December contributions paid in January.

- The tax can be reduced by no more than 50%, despite the fact that the amount of insurance payments may be more than half of the calculated tax liability. Thus, to find out by what maximum amount you can reduce your tax liability, you need to divide the tax amount in half.

IMPORTANT! This rule does not apply to individual entrepreneurs without employees. They can reduce the simplified tax system by the amount of fixed insurance payments to the Pension Fund and the amount of payment calculated when the income received exceeds 300,000 rubles, regardless of the restrictions, in full.

When are insurance payments accepted to reduce the tax or tax base?

Regardless of which object is selected for calculating tax, when using the simplified tax system, contributions must be taken into account in expenses or applied as a tax reduction when they were transferred in fact and in the amount of the amounts actually transferred. You need to understand that payments must be transferred no later than the end of the calendar reporting year. If the transfer of payments is postponed to the beginning of the next period, then for the purpose of calculating the simplified tax system (advance payment), the amount of such transfer can only be taken into account during the period of transfer of funds to extra-budgetary funds.

Thus, if contributions for 2015 were transferred in January 2016, then for the purpose of calculating the single tax, these amounts cannot be taken into account in expenses or in tax reduction. They will be taken into account when calculating tax for 2016 (for the advance payment for the 1st quarter).

Let's consider the situation regarding the part of the contribution to the Pension Fund, equal to 1% of the excess income over 300,000 rubles. (the so-called additional contribution). This payment is made by self-employed persons. The amount of such payment reduces the tax or tax base of the period in which it was made. Payment of the additional contribution may be scheduled for the 1st quarter of the year following the year in which the excess income occurred (i.e., it amounted to more than RUB 300,000). Then, accordingly, the decrease will concern the advance payment or the base for the 1st quarter.

Entrepreneurs using the simplified tax system are payers of insurance premiums, since even if they do not have hired personnel, they remain obligated to pay contributions to the Pension Fund in a fixed amount for themselves.

For some categories of simplifiers, preferential rates apply for calculating insurance premiums.

The single tax on the simplified tax system can be reduced by the amount of insurance payments, and in systems with different objects of taxation, different approaches to accounting for contributions in determining the tax apply.

For the simplified tax system “income” there are a number of features that need to be remembered when calculating the single tax. For example, the tax can be reduced by no more than 50% if contributions are calculated on employee benefits and the contributions must be paid in the same period for which the tax is assessed. For individual entrepreneurs without employees, the 50% limit does not apply - he can reduce the tax by the entire amount of contributions transferred to the Pension Fund.

Simplified workers who use the “revenue minus costs” object in their activities can adjust the amount of payments according to the level of profitability. But for individual entrepreneurs and companies at a rate of 6%, the legislation also provides tax reduction on the amount of contributions to the simplified tax system.

How are the tax base and tax determined?

The tax base (TB) is the sum of all cash receipts, on the basis of which the transferred amounts are calculated. The tax under the simplified tax system (N) is calculated as follows:

N = NB x Rate

Taxes are imposed on cash and non-cash funds, advance payments on account of future shipments, and assignment of claims. Detailed information on this matter is contained in Art. 346.16 Tax Code of the Russian Federation. Accounting for incoming income is carried out on an accrual basis. They do not include:

- assets provided in the form of a deposit;

- money contributed by the founders to capital;

- credits and loans;

- targeted funds.

How to reduce tax with simplified tax system 6%

Being on the “income” simplification, entrepreneurs or organizations can change the tax if in the current reporting period expenses are made for:

- insurance contributions for employees to extra-budgetary funds;

- payment of sick leave, maternity leave, etc. (with the exception of occupational diseases and emergencies);

- voluntary insurance in case of temporary disability (subject to certain conditions);

- trade tax established by the Tax Code.

It is worth noting that reduction of tax on contributions under the simplified tax system of 6% “income” It is possible even if an individual entrepreneur does not have his own staff, if he voluntarily makes the above-mentioned deductions for himself.

What conditions to comply with?

Please note that the bank may deduct a commission from the transferred funds. Then the individual entrepreneur or company restores them in full amount of receipts and makes contributions from the amounts passed through the cash register. Reducing the simplified tax system for the amount of insurance premiums possible if two conditions are met:

- Payments were made in the current reporting period.

- Insurance premiums are accrued during the period of application of the simplified tax system. That is, it is impossible to take into circulation the repayment of debt to funds formed under the general taxation regime, UTII or others.

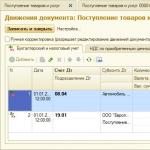

In 2016, all changes must be reflected in the declaration under the simplified tax system. This requirement is established by order of the Federal Tax Service No. ММВ-7-3/99@. Below you will find a fragment of the declaration under the simplified tax system “income”, where insurance premiums reduce this tax.

EXAMPLE 1

Individual entrepreneur Frolov received an income of 200,000 rubles for the first quarter. There are no hired workers. In April, funds in the amount of 8,000 rubles were transferred to their own pension provision. How much simplified tax do I need to pay?

Solution.

- Basis for the tax on the simplified tax system: 200,000 x 6% = 12,000 rubles.

- Funds to be transferred will be: 12,000 – 8,000 = 4,000 rubles.

EXAMPLE 2

The Iceberg company received an income of 960,000 rubles. (for six months), from which you need to make a contribution to extra-budgetary funds for employees in the amount of 350,000 rubles. How much is possible? reduction of tax on insurance premiums (under the simplified tax system 6%)?

Solution.

- Let's determine the tax on the simplified tax system: 960,000 x 6% = 57,600 rubles.

- The maximum amount by which deductions can be reduced: 57,600 x 50% = RUB 28,800.

- The amount of deducted funds will be: 350,000 – 28,800 = 321,200 rubles.