I propose to consider in this article a detailed example of accepting fixed assets for accounting in 1C 8.3 in the form of step-by-step instructions. The accounting procedure for such assets is determined by PBU 6/01 “Accounting for Fixed Assets”.

When purchasing a fixed asset, an accounting entry is generated 08.04 – 60.01 (details - ). It follows from this that the equipment is simply listed “in warehouse” under account 08.04 “Purchase of fixed assets” and is not operated, and depreciation is not charged on it.

In order for the purchased equipment (machine, car, computer, etc.) to begin to be listed as a fixed asset in the organization and to begin to be depreciated, it is necessary to correctly take it into account.

Let's figure out what it means to accept for accounting in 1C 8.3. From an accounting point of view, this means that it needs to be moved from account 08.04 to account 01.01 “Fixed assets in the organization.” The program also requires parameters for calculating depreciation both in accounting and in .

For all this, there is a document “Acceptance for accounting of fixed assets”. Let's take a closer look at it.

Creating and filling out the document “Acceptance for accounting of fixed assets”

To create a new document, go to the “OS and” menu, then click the link “Acceptance for accounting of OS”. A window with a list of documents will open. In this window, click the “Create” button. A window for creating a new document will appear:

In the header of the document we will indicate the organization, division (location of the OS), the financially responsible person and the OS event.

Get 267 video lessons on 1C for free:

Let's move on to the first tab “Non-current asset”. We select the equipment that we want to take into account. We will also indicate the warehouse where it is stored.

On the “Fixed Assets” tab, enter a list of fixed assets to be accepted for accounting. In our case, this will be one line that corresponds to the equipment:

In addition to selecting a fixed asset, you need to assign an inventory number on this tab. By default, this number is automatically substituted from the “Fixed Assets” directory (the “Directories” menu, then the “Fixed Assets” link).

Briefly about this directory: it stores all the parameters of the fixed asset and changes documents during operation.

For example, we can change the inventory number in our created document, which was taken from the directory. After posting the document in the directory, this number will also change. Entries in such a directory are also called fixed asset cards.

Setting up parameters for calculating depreciation of fixed assets in 1C 3.0

Note that the most clear criterion for determining the date of acceptance of a fixed asset for accounting is given in IFRS: depreciation of an asset begins from the moment it becomes available for its intended use.

To do this, let’s look at step-by-step instructions for accepting a fixed asset for accounting using a specific example in 1C Accounting 8.

1. Acceptance of fixed assets for accounting

Commissioning of the OS in 1C is carried out using the document “Acceptance of accounting for the OS”. To create it, go to “OS and intangible assets - Receipt of assets - Acceptance for accounting of assets - Create”.

2. Fill out the header

In the header of the created document, put the date the OS was accepted for accounting, indicate the current location of the OS, and select the responsible person from the “Individuals” directory. In the “OS Events” field, indicate “Acceptance for accounting with commissioning.”

3. Go to the “Non-current asset” tab.

Go to the “Non-current asset” tab. In the “Type of operation” line, select “Equipment”. In the “Hardware” line, click on “Select from list” and select the OS object you need from the “Nomenclature” directory that opens. In the “Warehouse” line, indicate the location of the fixed assets object before commissioning.

4. Fill in the OS tab

Go to the “OS” tab and add a new line using the “Add” button. From the OS directory we select the form of the object we need. We indicate its full and abbreviated name. Set the “OS object” switch.

5. Select the OS category

Fill in the lines “Accounting group”, “OKOF code”, “Depreciation group” with the necessary data, selecting the required items using the “Select from list” button. To save the information, click “Save”.

6. Go to the “Accounting” tab.

We indicate the account on which the fixed assets will be recorded.

In the line “Depreciation account” we indicate the account to which depreciation is planned to be calculated. Check the “Calculate depreciation” checkbox.

In the “Depreciation calculation method” line, select the linear method (click on the “Select from list” button). We fill in the line “Useful life” and, if necessary (seasonal production) - “Depreciation schedule by year”.

In the line “Method of reflecting depreciation expenses”, using the “Select from list” button, select the directory “Methods of reflecting expenses”. We indicate the method we need from it or create a new one (click on the “Create” button). All subsequent postings will be generated using the method you choose.

7. Go to the “Tax Accounting” tab.

In the line “Procedure for including costs in expenses”, indicate the appropriate item from the list. In the example under consideration, this is “Depreciation”. Check the box “Calculate depreciation”.

Fill in the line “Useful life” and indicate the coefficient in the line “Special. coefficient” (if the coefficient is not equal to one).

8. Depreciation bonus

On the “Depreciation bonus” tab, check the “On” line. bonus depreciation as an expense”, if this right is included in the accounting policy of your company.

We hope our article was useful to you, and putting OS into operation in 1C

will not cause you any difficulties!

The received fixed asset (car, building, machine, etc.) must be taken into account in order for the VAT on its acquisition to be reflected in the purchase book, and.

The document “Receipts (acts, invoices)” generates postings 08.04 – 60.01, which means its receipt at the warehouse. In order to correctly accept OS for accounting in 1C 8.3 Accounting, a second posting is required from account 08.04 to 01.01. It is precisely this that is formed when it is accepted for accounting.

It is important to remember that in 1C 8.3 Accounting 3.0, starting from 2017-2018 (version 3.0.45), the developers significantly simplified this procedure by introducing a new type of operation “Fixed assets” for the document “Receipts (acts, invoices)”.

When registering a receipt in this way, the document generates both transactions, that is, there is no need to additionally accept the fixed asset for accounting. The fixed asset will immediately be listed in the account on 01.01. You can read more about this type of operation in the article “”.

In this example, we will consider the situation when you issued a receipt with the type of operation “Equipment”. In this case, you have only one posting - for account 08.04. We need to place the OS on account 01.01.

In the “Fixed assets and intangible assets” menu, select “Acceptance for accounting of fixed assets”.

In the document list form that opens, click on the “Create” button.

In the header, indicate the financially responsible person and the location of the OS, but these fields are not mandatory.

On the first tab of the document, fill in the method of receipt and department. In the equipment field, select the item item for which the receipt was previously created. The account will be filled in automatically, but you can change it.

Fixed assets

Next, go to the “Fixed Assets” tab. Add all required operating systems to the table. The default inventory number will be substituted from the directory details of the selected OS. It can be changed and then when you post a document, it will also change in the directory.

It is important to know! If you need to add several identical fixed assets (for example, 5 fixed assets), then in the fixed assets directory you should have 5 such elements with different inventory numbers.

Accounting and depreciation parameters

Go to the Accounting tab. By default, during commissioning in 1C 8.3, the account 01.01 was entered. We will not change this value. In the “Accounting procedure” attribute, set the value to “Depreciation calculation” and setting the parameters for depreciation calculation will become available.

By default, the linear method of accounting for depreciation will be used. This method is the most common. When using it, the cost of the accounting object is reduced in equal parts over the service life.

Fill in the depreciation account, useful life and other fields. There shouldn't be any problems with them.

Tax accounting

Go to the “Tax Accounting” tab. Indicate the original price of the OS according to NU, the date of purchase and the number of months of useful use.

Our organization is on the simplified tax system, so it is important to correctly indicate the procedure for including costs in expenses. It shows whether the asset is being depreciated and how such expenses are accounted for.

Below you must provide information about payments for all expenses before the object was accepted for accounting. All further payments must be made using the document “Registration of payment for fixed assets and intangible assets.”

With other tax systems, you do not need to indicate the payment. You will have to indicate the depreciation bonus - a percentage of the cost of the asset that can be written off for its construction or purchase.

Watch also the video on how to buy an OS and register it:

In 1C there are two options for registering the acquisition and accounting of fixed assets:

Standard, in which two documents are used:

- capitalization of OS - using a document Receipt (act, invoice) type of operation Equipment ;

- OS commissioning - using the document Acceptance of fixed assets for accounting .

Simplified, in which a single document is used:

- capitalization and commissioning of OS - document Receipt (act, invoice) type of operation Fixed assets .

When the commissioning of the OS is carried out simultaneously with the capitalization of the OS, then, of course, it is more convenient to reflect all operations in one document: use Simplified version. But it has some limitations.

The simplified option cannot be used if additional costs will be added to the initial purchase price of the fixed asset upon its acquisition.

How to accept an OS for accounting in 1C 8.3: standard method

With the standard method, two documents are drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Equipment ;

- document Acceptance of fixed assets for accounting ;

Let's consider the features of filling out each document and their implementation.

Document Receipt (act, invoice) type of operation Equipment

You can register the capitalization of fixed assets using this document through:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – Equipment section;

- OS and intangible assets – Receipt of fixed assets – section Receipt of equipment.

So, for example, in 1C Accounting 8.3 it is recommended to purchase a car that we plan to use on public roads through the standard option, because the initial cost of the car will include additional costs - in this case, the fee for its registration with the traffic police.

On the tab Equipment enter the purchased fixed assets and indicate their quantity. Select fixed assets from reference book Nomenclature.

When posting a document, the initial cost of a non-current asset will be taken into account in the “Purchase of components of fixed assets” account until it is entered document Acceptance for accounting of fixed assets.

Learn more:

Document Acceptance for accounting of fixed assets

You can accept fixed assets for accounting using this document through:

- Fixed assets and intangible assets – Receipt of fixed assets – section Acceptance for accounting of fixed assets.

On the tab Non-current asset indicate the details of the acquired asset before commissioning:

- Equipment - non-current asset put into operation; select from reference book Nomenclature;

- Main warehouse - storage location of the registered object;

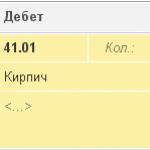

- Check- a cost account where the initial cost of an object is formed.

On the tab Fixed assets select the OS to be put into operation from the directory Fixed assets .

Set the parameters for calculating depreciation and paying off the cost of objects on separate tabs Accounting And Tax accounting .

On the tab Accounting please indicate:

- Account- accounting account put into operation of the OS;

- Accounting procedure

:

- Depreciation calculation;

- The cost is not repaid.

When selecting a value Depreciation calculation set the parameters for its accrual.

On the tab Tax accounting install .

Depending on the procedure for accounting for the costs of purchasing an object in the NU in the field The procedure for including costs in expenses can choose:

- Depreciation calculation- for fixed assets for which depreciation will be calculated;

- Inclusion in expenses upon acceptance for accounting- for objects, the costs of acquiring them at a time will be taken into account in expenses when accepting them for accounting;

- Cost is not included in expenses- for objects, expenses for which will not be taken into account in expenses that reduce the tax base.

For NU it is impossible to select the depreciation calculation method in the document, because it is set in the accounting policy settings and applied to all OS objects. In 1C, the method is installed in the block Main – Settings – Taxes and reports – Income Tax section.

For objects for which depreciation is charged, it is possible to charge a depreciation bonus. Its parameters are set on a separate tab Depreciation bonus .

The document generates transactions:

Learn more:

- OS commissioning

- Acceptance for accounting of fixed assets not accounted for in NU

How to register an OS in 1C 8.3: a simplified method

With the simplified method, a single document is drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Fixed assets .

Document Receipt (act, invoice) type of operation Fixed assets

You can register a fixed asset using this document through:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – section Fixed assets;

- OS and intangible assets – Receipt of fixed assets – section Receipt of fixed assets.

In the tabular section, reflect the purchased objects from directory Fixed assets. It is not possible to indicate the number of objects in the document: only one item in the quantity of one object can be accepted for accounting. Add identical items of fixed assets to the directory Fixed assets separate positions and differentiate them according to certain criteria, for example, by workplace (WM).

According to the parameters for calculating depreciation and repayment of the cost of objects, it is possible to indicate only:

- Method of reflecting depreciation expenses in the document header - the same for all entered objects;

- Life time in the tabular part - the useful life, which is set to be the same for NU and BU, specifically for each object.

1C Accounting 8.3 itself in tax accounting determines the procedure for repaying the cost of the acquired object:

- if the cost of the object is no more than 100,000 rubles, the acquisition costs are included in expenses at a time;

- if the cost of the object is more than 100,000 rubles, then depreciation will be calculated according to the method established in the accounting policy for NU.

Regardless Accounts in the tabular part of the document, the costs of acquiring fixed assets will be automatically taken into account in the “Purchase of fixed assets” account, and then written off to Account, set in the document.

In one of the previous articles, we looked at the process of purchasing fixed assets using the accounts of group 106.00 “Capital Investments”. When all costs are collected in the account we need, we can accept the fixed asset for accounting. This moment comes when the fixed asset is delivered, collected and ready for registration. It is this process that will be discussed in the article; a practical example will be considered in the 1C program: Accounting of a government institution 8 edition 2.0.

When I started studying accounting in general and the “Fixed Assets” section in particular, I was very interested in the question of the differences in the states of fixed assets at different stages.

The first state that a fixed asset assumes is a capital investment. In the last article, we figured it out: a fixed asset remains as a capital investment as long as we collect costs in the accounts of group 106.00 to form its initial cost (more details: Purchase of fixed assets in 1C: Accounting of a government agency 8).

The second state is the main asset accepted for accounting. The condition of a fixed asset is defined as accepted for accounting when it is reflected in the accounts of group 101.00, is physically located on the territory of the institution, and its value is listed on the balance sheet. That is, simply put, it is already considered a fixed asset, but the institution does not use it (it has not been put into operation). I would like to clarify that usually this state of fixed assets is used very rarely, since acceptance for accounting, as a rule, is carried out simultaneously with commissioning.

The third state is that the OS has been put into operation. That is, the fixed asset is also located in the accounts of group 101.00 and fulfills its duties as a means that is intended to simplify working conditions.

In the program “1C: Public Institution Accounting 8, edition 2.0”, acceptance for accounting and commissioning can be carried out in one document. This is done for the convenience of users, since this algorithm for working with fixed assets (simultaneous acceptance for accounting with commissioning) is the most common.

Let's consider what documents are used to accept fixed assets for accounting. The program has a section of the same name:

This section presents three types of documents:

1. The document “Acceptance for accounting of fixed assets, intangible assets, legal acts” can be used to accept fixed assets for accounting; with this document, you can simultaneously put the fixed asset into operation.

2. The document “Requirements-invoices (Fixed Assets)” is used to put into operation fixed assets previously accepted for accounting, the cost of which is above 3,000 rubles (with the possibility of moving to another financially responsible person). Let me clarify that for fixed assets less than 3,000 rubles, the program has a separate document:

3. The document “Transfer of finished products into fixed assets” is intended to be accepted for accounting as fixed assets of finished products. This document allows you to accept for accounting and at the same time put into operation finished products as OS.

Attention, an important clarification: when carrying out production processes in an institution (production of finished products), the formation of the actual cost of finished products occurs at the end of the month with the document “Closing production accounts”, the entire month the products are reflected in accounting at the planned cost. This means that it is impossible to take into account fixed assets from finished products that were produced in the current month! Let me explain why: acceptance for accounting will be carried out at the planned cost, but it does not reflect the real price of the fixed asset, and the initial cost of the fixed asset can be changed only for a very limited range of reasons.

We have sorted out the documents of acceptance for accounting and commissioning. Let's consider the most common scenario: after purchasing a fixed asset, we will accept it for accounting and simultaneously put it into operation.

Let's create a document:

When creating a document, a window opens that lists the types of receipts of fixed assets:

The names of the types of OS income speak for themselves.

The first three types of receipts relate to the acceptance for accounting on balance sheet accounts:

Other types of income go to off-balance sheet accounts:

Since in our example we are purchasing a fixed asset, we will select the appropriate type of receipt:

After selection, the document form opens (the type of receipt is indicated in the header):

The next important fields are the type of property and the CFO. Here you need to be very careful, because when purchasing fixed assets, capital investments were also made for a certain type of property and according to a certain KFO. If incorrect data is selected, it will be impossible to select a fixed asset and calculate its initial cost.

Let's fill in the remaining fields of the document header:

Let's move on to filling out the tabs. The first tab of the document is “General Information”:

We fill in the financially responsible person (the one on whom this fixed asset will be listed), select the counterparty and its agreement (from whom the purchase was made). The remaining fields are optional:

The next tab is “Investment Value”. On this tab, the initial cost of the fixed asset is calculated (if the receipt of the fixed asset itself and the services for its assembly/delivery and other related services were done correctly). Initially, we select the investment object (the fixed asset that we accept for accounting):

After the fixed asset has been selected, almost all the fields of this tab are filled in (if any mistakes were made earlier, the data will be incorrect, for example, the full amount will not be indicated):

In the “Quantity” field, the program itself sets the number. But if the initial cost of a fixed asset was formed from several factors, then the program may not be able to determine the quantity. In this case, the field is filled in by the user.

After checking the data, go to the next tab - “Fixed assets, intangible assets, legal acts”:

This is one of the most important tabs of the document. It is a table that must be filled in with a list of fixed assets. Click the “Add” button to create a new line:

Some of the data is filled in automatically; let’s add information on the accounting account and the service life of our fixed asset:

In the table of this tab you can also use three options in parallel:

1. Assign an inventory number to the fixed asset;

2. Simultaneously with acceptance for accounting, put the fixed asset into operation and indicate all the data to be reflected in accounting;

3. Create an inventory card for the fixed asset.

Let's consider these possibilities in order:

1. You can assign an inventory number to a fixed asset from the following field:

The number assignment window opens:

If your institution has adopted a template and entered it into the appropriate directory, the fields are filled in automatically. Create and close:

2. Put into operation:

Let's fill in the data to be reflected in accounting:

A window opens:

Fill in the data:

Since our fixed asset is more expensive than 40,000 rubles, we indicate that it is necessary to calculate depreciation and charge these costs to general business expenses.

3. Create an inventory card for a fixed asset - set the flag in the appropriate field:

It is also necessary to fill out the “Commission” tab, indicating the responsible persons of the institution.

Then go to the “Accounting Operation” tab. We select a standard operation, and the selection program offers us the operation that corresponds to the type of receipt:

Most of the form fields are filled in automatically; all you have to do is select the cost type:

Let's go through the document and look at the postings it generated:

The first entry writes off the capital investment and accounts for the fixed asset in the accounts of group 101.00. Depreciation in this case was not calculated, since depreciation is accrued in the month following the month when the fixed assets were taken into account. The second entry concerns tax accounting.