In the "Accounting" configuration, edition 4.4, the ability to calculate the actual cost of materials is implemented, which includes two functions: the actual adjustment of the cost of materials in accounting and the write-off of permanent differences in the cost of materials. 1C methodologists spoke in more detail about these functions in one of the latest releases of the ITS disk.

Adjustment of actual cost of materials

The adjustment is made if the organization's accounting policy provides for the write-off of materials based on the average monthly actual cost (weighted estimate), which includes the quantity and cost of materials at the beginning of the month and all receipts for the month (reporting period).

Note that with such an accounting policy, the periodic constant “Option for using average estimates of the cost of materials” should have the value “Weighted estimate (based on the average monthly cost)” on the date of the “Month Closing” document.

During the month, a sliding estimate is used in expenditure documents when writing off the cost of materials. In this case, the average cost of material assets is determined at the time of their release (that is, at the time of the document on consumption). If during the month there was a purchase of materials at prices different from the average cost of balances for the corresponding items, then the rolling estimate for write-off gives slightly different results than the weighted one*.

Note:

* The terms “weighted assessment” and “rolling assessment” were introduced into practice by the Methodological Guidelines for Accounting for Inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Example.

Let’s say that as of May 1, 2002, there were 100 kg of nails worth 2,400 rubles in the warehouse of Nasha Stroika LLC.

On May 4, 2003, 10 kg of nails were supplied. Their cost was 240 rubles. (2400:100x10). The balance in the warehouse after this operation is 90 kg in the amount of 2,160 rubles.

On May 13, 2003, 20 kg of nails were received into the warehouse at a price of 30 rubles. for 1 kg, in the amount of 600 rubles. On May 20, 2003, 10 kg of nails were supplied; their cost based on a rolling estimate will be (2,160+600): (90+20)x10=250.91 rubles.

Thus, a total of 20 kg of nails were written off in the amount of 490.91 rubles. (240+250.91).

With a weighted assessment, the cost of written-off nails will be (2,400+600): (100+20)x20=500 rubles.

The difference is small (500-240-250.91=9.09), but it exists. If the release of the first 10 kg of nails occurred after the purchased batch arrived at the warehouse, then the difference would be zero.

The procedure “Adjustment of the average cost of writing off materials” makes additional entries in accounting in such a way that the write-off was ultimately (for the month as a whole) made using the weighted average cost method.

The specific algorithm is as follows:

1. The average monthly cost is calculated for each material for each subaccount of account 10 (except for subaccount 10.7 “Materials transferred for processing” and subaccount 10.11 “Special equipment and special clothing in use”);

2. For each of the accounts (and objects of analytical accounting for them, that is, subconto) to which the material in question was written off, the adjustment amount is calculated: the difference between what should have been written off using the average monthly cost method (the product of the average monthly price of the material by its the amount written off within the framework of this correspondence of accounts) and the amount actually written off;

3. An entry is made for the amount of the adjustment.

Example (continued).

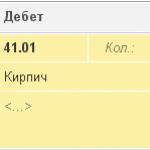

The adjustment in our case will be 9.09 rubles, as calculated above. If during the month both cases of material write-off were reflected in the debit of account 20 “Main production” for the same accounting object (for example, construction of a fence) and the credit of account 10.1 “Raw materials and materials”, then the following entry will be made when adjusting :

Debit 20 Credit 10.1 - 9.09 rub.

If the first write-off was made to account 20, and the second to account 26 “General business expenses” (for example, for repairs of office premises), then the adjustment will be made as follows.

The average cost of 1 kg of nails per month will be 25 rubles.

Subaccounts of account 10.11 “Special equipment and special clothing in operation” have special analytics (subaccount “Purpose of use”, as well as “Employees” or “Divisions”) and a special procedure for reflecting transactions described in the Guidelines for accounting for special tools and special devices , special equipment and special clothing, approved by order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n. Therefore, for these subaccounts, the algorithm for adjusting the cost of materials is performed in a special way:

- adjustments are made only for those accounting objects, the cost of which is completely written off upon transfer to operation (for other objects, a special adjustment is not necessary, since the gradual write-off of the value of these objects begins only from the month following the month of transfer to operation, and the value of the assets will already be reflected taking into account all adjustments);

- during execution, additional analytics are taken into account (that is, for each purpose of use, etc. separately).

Write-off of permanent differences in the cost of materials

If an organization applies the provisions of PBU 18/02 “Accounting for income tax calculations” (the constant “PBU 18/02 is applied” is set to “Yes”), then when performing this procedure, permanent differences related to materials and accounted for are calculated and written off. on the auxiliary off-balance sheet account NPR "Permanent differences" (sub-account NPR.10).

Just as when adjusting the cost of materials, permanent differences are calculated and written off separately for subaccounts of account 10.11 “Special equipment and special clothing in operation” (differences are written off from the credit of subaccount NPR.10.2) and separately for the remaining subaccounts of account 10 (from credit subaccount NPR.10.1).

Permanent differences are written off in proportion to the cost of the materials themselves used for certain purposes. The calculation is made in the following order:

1. The balance of material in quantitative terms at the beginning of the month is added to the amount capitalized during the month (in this case, returns to suppliers and internal movements are subtracted from the total quantity of materials capitalized).

2. By dividing the sum of permanent differences reflected in the NPR account by the total amount of material (obtained in the previous paragraph), the average sum of permanent differences per unit of material is obtained.

3. The amount of permanent differences written off to the corresponding subaccount of the NPR account is determined as the product of the amount of permanent differences per unit of material by the amount of material spent for certain purposes.

The permanent differences are written off as follows.

The account to which the cost of materials is charged |

Sub-account of the NPR account to which permanent differences are written off |

| 10.11 “Special equipment and special clothing in operation” (any subaccount) | NPR.10.2 |

| Subaccounts of account 10 "Materials", except for subaccount 10.11 | NPR.10.1 |

| 20 "Main production", type of item with type "Service (UTII)" | Not indicated, since differences are subject to write-off without further accounting |

| 44.1.2 "Costs of distribution in organizations engaged in trading activities subject to UTII" | Not indicated, since differences are subject to write-off without further |

| Subaccounts of account 90 "Sales", not related to UTII (90.2.1, 90.7.1, 90.8.1), accounts 91.2 "Other expenses" and 99 "Profits and losses" | NPR.99 |

| Other accounts (23, 25, 29, 41, etc.) | The code of the subaccount of the NPR account coincides with the code of the account to which the cost of materials is attributed |

In conclusion, we note that in connection with the described function of writing off permanent differences, organizations that apply the norms of PBU 18/02 and which have permanent differences in the cost of materials must carry out the procedure “Calculation (adjustment) of the actual cost of materials” even if actual adjustment of the cost of materials in accounting is not required (a weighted estimate of the average cost of materials is used).

2017-04-25T12:44:19+00:00What kind of animal is this? Nomenclature adjustment"? I am quite often asked this question by novice accountants, because they do not understand where this adjustment comes from, how it is calculated and whether it is necessary.

Let's figure this out once and for all using the example of 1C: Accounting 8.3, edition 3.0.

Firstly, the adjustment occurs “by itself” when closing of the month.

Secondly, it occurs most often for organizations that are writing off inventories at average cost().

And that's why.

If we carefully read paragraph 18 of PBU 5/01 on the approval of accounting regulations, we will see the following there:

The assessment of inventories at average cost is carried out for each group of inventories by dividing the total cost of the group of inventories by their quantity, consisting respectively of the cost price and the amount of balance at the beginning of the month and the inventory received during the given month.

The same thing in the form of a formula:

Average cost inventory groups = ( Cost at the beginning months + Received cost within a month) / ( Quantity at the beginning months + Received quantity within a month)Which means the average cost should be calculated in general for the month .

Let's look at an example:

- 01.01.2014 We bought 4 bricks for 250 rubles.

- 05.01.2014 They sold 3 bricks for 500 rubles.

- 10.01.2014 We bought 2 bricks for 200 rubles.

Let's calculate average cost bricks for January:

- Cost at the beginning month = 0 rubles.

- Received cost within a month = 4 * 250 + 2 * 200 = 1400 rubles.

- Quantity at the beginning months = 0 pieces.

- Received quantity within a month = 4 + 2 = 6 pieces.

Total, according to the formula:

Average cost for January= 1400 / 6 = 233.333 rubles.

But as of 01/05/2014, when we sell 3 bricks, we do not yet know about subsequent receipts during the month, so we write off the cost without taking into account subsequent receipts:

Average cost as of 01/05= 4 * 250 / 4 = 250 rubles.

Thus, on 01/05 we will write off our brick by 250 rubles per piece, but at the end of the month it turns out that it was necessary to write off at 233.333 rubles (cheaper brick arrived on January 10).

So there was a difference of (250 - 233.333) = 16.666 rubles per piece, which needs to be adjusted at the end of the month.

The adjustment amount for 3 bricks sold will be 3 * 16.666 = 50 rubles.

Let's check this example in the 1C: Accounting 8.3 program (edition 3.0).

We make a write-off dated 01/05/2014

We are making receipts from 01/10/2014

Finally, we close the month for January

Left-click on the “Adjustment of item cost” item and select the “Show transactions” command:

Here is our adjustment of 50 rubles.

We're great, that's all

By the way, for new lessons...

Is it possible to make adjustments with FIFO?

Yes, it's possible. And now I will show with an example when it can arise.

So, we are on FIFO (first in first out), which means goods are written off in the order they arrive at the warehouse.

Let's look at an example:

- 01.01.2014 We bought 1 brick for 100 rubles.

- 03.01.2014 We bought 1 brick for 150 rubles.

- 06.01.2014 Sold 1 brick. At the same time, the cost of 100 rubles was written off (after all, we are on FIFO).

- 10.01.2014 Additional expenses were received in the form of 20 rubles for the receipt of bricks dated 01/01/2014. We registered them in 1C with the document “Receipt of additional expenses”.

- 31.01.2014 We closed the month and it adjusted the write-off on 01/06/2014 by 20 rubles, since in fact the cost of the bricks received on 01/01/2014 turned out to be not 100 rubles, as we thought at the time of write-off, but 120 rubles (+20 rubles of additional expenses that we entered 10 as the number).

Sincerely, Vladimir Milkin(teacher

In the Directory of Business Operations. 1C:Accounting added a practical article “Adjusting the cost of materials at the end of the month (average cost)”, which discusses an example where an organization writes off materials for production at a moving average cost. At the end of the month, the cost of written-off materials is adjusted to the weighted average.

Clause 16 of PBU 5/01 “Accounting for inventories” (approved by order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n) (hereinafter referred to as PBU 5/01) it is determined that when release of materials(and other inventories) into production, an enterprise for accounting purposes can write off their value in one of the following ways:

- at the cost of each unit;

- at average cost;

- at the cost of the first acquisition of inventories (FIFO method).

Materials evaluation at average cost occurs for each group (type) of inventory by dividing the total cost of the group (type) of inventory by their quantity, consisting respectively of the cost price and the amount of balance at the beginning of the month and the inventory received during a given month (clause 18 of PBU 5/01). In this case, the application of methods for average estimates of the actual cost of materials can be carried out in the following ways:

- based on the average monthly actual cost ( weighted assessment), which includes the quantity and cost of materials at the beginning of the month and all receipts for the month (reporting period);

- by determining the actual cost of the material at the time of its release ( rolling estimate), while the calculation of the average estimate includes the quantity and cost of materials at the beginning of the month and all receipts until the moment of release.

If in the program account policy settings "1C: Accounting 8" If the method for assessing inventories is established “At average cost”, then materials are written off to production at the average moving cost. When closing the month, the cost of written-off materials is brought to the weighted average.

In addition, in connection with the release of new releases, practical articles according to the edition have been updated in the reference book.

Routine operations for closing the month in the program "1C: Integrated Automation 8"

3.0 et ed. 2.0 “Accounting for fines (penalties) received under the contract (supplier’s position)”, “Registration of an incoming invoice (from the supplier)” and “Partial return of goods from the buyer”.

For other directory news, see here.

<<< Назад

Closing operations of the reporting period

Adjustment of the average cost of materials write-off

This procedure is necessary if the organization’s accounting policy provides for the write-off of materials based on the average monthly actual cost (weighted estimate), which includes the quantities and costs of materials at the beginning of the month and all receipts for the month (reporting period). During the month, a sliding estimate is used in expenditure documents when writing off the cost of materials. In this case, the average cost of material assets is determined at the time of their release (i.e. at the time of the document on consumption). If during the month there was a purchase of materials at prices different from the average cost of balances for the corresponding items, then the rolling estimate for write-off gives slightly different results than the weighted one.

Comment:

Terms "weighted assessment" And "rolling estimate" introduced into practice by the “Methodological guidelines for accounting of inventories”, approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n.

Example.

Let as of 05/01/2003

Post navigation

There were 100 kg in the warehouse of Our Organization LLC. nails worth 2400 rubles.

On May 4, 2003, 10 kg of nails were supplied. Their cost was 240 rubles. (2400:100*10). The balance in the warehouse after this operation is 90 kg in the amount of 2160 rubles.

On May 13, 2003, 20 kg of nails were received into the warehouse at a price of 30 rubles. for 1 kg, in the amount of 600 rubles.

On May 20, 2003, 10 kg of nails were supplied, their cost based on a rolling estimate will be (2160+600): (90+20)*10=250.91 rubles.

Thus, a total of 20 kg of nails were written off in the amount of 490.91 rubles. (240+250.91)

With a weighted assessment, the cost of written-off nails will be (2400+600).(100+20)*20=500 rubles.

There is a difference between the two assessment methods (500-240-250.91 = 9.09 rubles). If the release of the first 10 kg of nails occurred after the purchased batch arrived at the warehouse, then the difference would be zero.

The procedure makes additional accounting entries so that the write-off is ultimately (for the month as a whole) made using the weighted average cost method.

The specific algorithm is as follows:

- the average monthly cost is calculated for each material for each subaccount of account 10 (except for subaccount 10.7 “Materials transferred for processing”);

- for each of the accounts (and analytical accounting objects for them, i.e. subconto) to which the material in question was written off, the adjustment amount is calculated. It is equal to the difference between what should have been written off using the average monthly cost method (the product of the average monthly price of the material and its quantity written off within the framework of this correspondence of accounts), and the amount actually written off;

- an entry is made for the amount of the adjustment.

Adjustment of the average cost of write-off of goods

The algorithm and purpose of this procedure in relation to account 41 “Goods” are similar to the algorithm and purpose of the procedure "Adjustment of the average cost of materials write-off".

If an organization accounts for goods in warehouses (account 41.1) at acquisition cost, and in retail trade (account 41.2) at sales prices, then the procedure for adjusting the average cost of writing off goods can, in principle, be applied only in relation to writing off goods from a warehouse.

However, in addition to adjusting the data on the write-off of goods from the credit of account 41 "Goods", when performing this procedure, an adjustment is also made to the average cost of writing off goods shipped (account 45).

The peculiarity of the algorithm for adjusting the average cost of goods shipped is that the calculation of the weighted average cost of a unit of goods in this case is carried out separately for each counterparty and contract.

This article begins a series of materials that will be devoted to operations "Closing of the month". When I first started learning software based accounting 1C Enterprise Accounting, then it was this section that caused me the most difficulty. This was due to the fact that I could not find detailed descriptions with examples of what each of the operations is and what it is done for. Now that I have managed to figure out a lot of things in practice, I want to present to your attention my achievements.

In this article we will look at one of the regulated month-end closing operations. This material is suitable for those who are just starting to study accounting and the mechanisms of operation of the 1C Enterprise Accounting software product. I will look at two simple examples that will allow you to clearly see how the cost of an item is adjusted.

Let me remind you that the site already has a number of articles that are devoted to the issue of closing a month in the 1C BUKH 3.0 program:

Why is it necessary to adjust the cost of an item?

I’ll tell you a little about why the cost of an item is adjusted in general. If the “average cost” method is chosen to determine the valuation of goods when they are written off, then according to clause 18 PBU 5/01 The average cost should be determined by dividing the total cost of the product by its quantity. These indicators should be the sum of cost and balance at the beginning of the month and incoming stocks within a month. Let me remind you that the choice of write-off method is carried out in "Accounting Policy" on the “Inventory” tab in the field “Method for assessing inventories (MPI).”

This approach cannot be implemented in a situation where the write-off value must be known at the time of write-off and write-off data for the entire month is not known. Therefore, the average cost of goods is determined at the time of write-off, and not at the end of the month. At the end of the month, when all receipts and write-offs are known, the average cost is adjusted by a regulated operation “Adjustment of item cost”.

I would like to draw your attention to the fact that the screenshots of this article are presented from the program 1C Accounting edition 3.0 with the new interface "Taxi", which became available starting from release 3.0.33. After updating the program to this release, it should prompt you to switch to this interface, but you can switch to any interface yourself. In the “Administration” section in the “Program Settings” item on the “Interface” tab.

Separately, I note that the functionality presented in this article is performed the same for any interface and this mechanism is also valid for 1C Accounting edition 2.0.

EXAMPLE 1

We will register the fact of receipt of goods using a document in the amount of 100 kg. at a price of 24 rubles. per kg. As a result, the program will generate the wiring:

- Write-off: 10 kg

Next, we will receive the same goods as before but at a different price of 30 rubles. per kg.. I would like to note that in the “Nomenclature” reference book the same element is selected as in the first two operations. So, let's reflect in the document “Receipt of goods and services” receipt of 20 units of material for a total amount of 600 rubles. 30 rub. per kg.. The document will generate transactions of the following type: Dt 41.01 Ch 60.01 Amount 600

- Write-off: 10 kg.

Now that there have been two receipts of the same product at two different prices, we will write it off in the amount of 10 kg. using document "Write-off of goods" on the count of 94 “Shortages and losses from damage to valuables”. So, at the time of write-off, we had 110 kg left. = 100 – 10 + 20 goods worth 2,760 rubles. = 2,400 – 240 + 600. The average cost of 1 unit will be 25.09 rubles. = 2,760 / 110. Accordingly, 10 kg will be written off. material for a total cost of 250.91 rubles. When posted, the document “Write-off of goods” will generate the following posting:

Dt 94 Kt 41.01 Amount 250.91

At the end of the month it is necessary to carry out regulated procedures "Closing of the month", including the procedure “Adjustments to the cost of items.” To implement the adjustment, you must select the “Month Closing” item in the “Operations” section of the program. This will open a specialized program service. Here you need to select the closing month, organization and either completely close the month by clicking on the appropriate button, or perform only the necessary operations. Left-click on the line “Adjustment of item cost” and click “Perform operation”.

After this, the program will create a document “Month Closing” with the type “Adjustment of item cost”. Its transactions can be viewed from the same service by left-clicking on the line “Adjustment of item cost”. The postings will look like this: Dt 94 Kt 41.01 Amount 9.09

Adjustment Amount = Weighted Average – Total Write-Off Amount

Weighted Average = Total Receipt Amount: Total Receipt Quantity * Total Write-Off Quantity = (2400 + 600): (100 + 20)*(10+10) = 500

Total Write-off Amount = 240 + 250.91 = 490.91

Adjustment Amount = 500 – 490.91 = 9.09

EXAMPLE 2:

Let me give you another example, a little more complicated.

- Receipt: 100 kg. 24 rubles/kg. = 2400

Wiring: Dt 41.01 Ch 60.01 Amount 2,400

- Write-off: 10 kg. on the count of 94

Wiring: Dt 94 Kt 41.01 Amount 240

- Receipt: 20 kg. 30 rubles/kg. = 600

Wiring: Dt 41.01 Ch 60.01 Amount 600

- Write-off: 10 kg. on the count of 94

Wiring: Dt 94 Kt 41.01 Amount 250.91

- Receipt: 10 kg. 35 rubles/kg. = 350

Unlike the first example, we will register another receipt of 10 kg. goods for 35 rubles. per kg.

Wiring: Dt 41.01 Ch 60.01 Amount 350

- Sales: 20 pcs. (debited to account 90.02.01)

We will execute the document “Sales of goods and services” sales 20 kg. goods. In this case, the goods will be debited from the account credit 41.01 “Goods in warehouses” to the debit of the account. 20 kg. the goods will be written off for the amount 519.83 = (Amount of Receipts – Amount of Write-offs) / (Quantity of Receipts – Amount of Write-offs) * Amount of Write-offs = (2400 – 240 + 600 – 250.91 + 350) / (100 – 10 + 20 – 10 + 10) * 20

Wiring: Dt 90.02.1 Kt 41.01 Amount 519.83

- Adjustment of item cost:

Let's perform the operation “Adjustment of item cost” closing of the month. In this case, two accounts will be used 90.02.1 “Cost of sales for activities with the main tax system” And 94 “Shortages and losses from damage to valuables.”

Postings: Dt 94 Kt 41.01 Amount 24.47

Dt 90.02.1 Ct 41.01 Amount -4.44

Now I’ll decipher where the amounts for each of the presented transactions came from:

Account Adjustment Amount = Account Weighted Average – Account Write-Off Amount

Account Weighted Average = Total Receipt Amount: Total Receipt Quantity * Account Debit Amount

1) For count 94:

CountWeighted Average94 = (2400 + 600 + 350):(100 + 20 + 10)*(10 + 10) = 515.38

Debit AmountAccount 94 = 250.91 + 240 = 490.91

Account Adjustment Amount 94 = 515.38 – 490.91 = 24.47

2) For account 91.02:

Weighted Average91.02 = (2400 + 600 + 350): (100 + 20 + 10)*(20) = 515.38

Debit AmountAccount 91.02 = 519.83

Account Adjustment Amount 91.02 = 515.38 – 519.83 = -4.44

That's all for today! If you liked this article, you can use social networking buttons to keep it for yourself!

Also, don’t forget your questions and comments. leave in comments!

In the following materials we will continue to consider month-end closing operations. To find out about new publications in time, you can. See you again!

The document “Adjustment of the cost of write-off of goods” is intended for routine adjustment of the cost of write-off of goods for the month.

When posting the document, an adjustment is made to the cost movements according to batch accounting for the month. Adjustment is necessary for:

Calculation of the weighted average cost of write-off of batches when using the “By average” method of assessing inventories;

Accounting for additional expenses for the purchase of goods capitalized after write-off of goods;

Accounting for additional expenses for the purchase of goods, capitalized before the receipt of goods by the documents “Customer declaration for import” and “Receipt of additional. expenses”, in which the party document is not indicated. These documents can be posted without specifying party documents only according to management accounting. Accordingly, when adjusting the cost of writing off goods, the distribution of pre-recorded additional expenses to receipts of batches is carried out (only for management accounting).

Important! Adjustment of the write-off value is not supported for the “Item Kit” document, the components of which include the kit itself

Features of filling out the “Organization” details when posting a management accounting document

Starting from version 1.2.15, the “Organization” attribute when posting a document by managerial accounting required for filling.

Filling out the “Organization” detail and the number of required documents “Adjustment of write-off value” depend on the settings for the method of maintaining management party accounting specified for enterprise organizations.

Organizations for which management party accounting for the organization " not carried out».

For such organizations, enter documents “Adjustment of the cost of write-off of goods” not required

for the company as a whole».

Must be entered one common document “Adjustment of the cost of write-off of goods” and indicate in it any of such organizations

Organizations for which management party records are maintained " by parent organization».

Must be entered one document at a time“Adjusting the cost of writing off goods” for each parent organization. In the “Organization” detail, indicate any of the organizations belonging to this parent organization

Organizations for which management party records are maintained "according to the current organization."

For each such organization it is necessary to enter separate document “Adjustment of the cost of write-off of goods”

Settings for methods of maintaining management batch accounting are made in the form «

setting up accounting parameters»

on the “Costs and Costs” tab

This is necessary for the correct operation of the complex VAT accounting mechanism if, for example, an enterprise has sales for export or sales without VAT.

Important! When using the advanced accounting and cost analytics mode, you do not need to enter the “Adjustment of the cost of writing off goods” document. Its functions are performed by the document “Calculation of production costs”