Alimony is withheld from wages either by a court decision or by a notarized agreement on its payment. The basis for this is almost all payments in favor of the employee from the company. In some cases, payment of alimony is possible from temporary disability benefits.

In this article we will show with an example* how alimony accounting is organized in 1 C 8.3 Accounting, if the enterprise has a simple automated payment system.

*The example described in this article can be considered working only if 1C 8.3 accounting is carried out at an enterprise with a staff of no more than 60 people.

Example “Withholding alimony in 1C”

A certain Petr Ivanovich Gerankin works in the Red Acacia organization as a manager. Salary 20,000 rubles. The organization received a writ of execution to withhold alimony. Retention conditions: start date - July 1, 2018, amount - 20%, to be paid in favor of Zinaida Petrovna Semenova. The transfer of alimony occurs by bank transfer to the bank account of the recipient Semenova, opened in the credit institution PJSC Sberbank of Russia. For the transfer, the credit institution takes a commission of 1% of the transfer amount, which the employer subsequently withholds from Petro Ivanovich Gerankin.

Step-by-step instruction

1. In the salary calculation settings, we find the operating mode “Payroll accounting and personnel records are maintained in this program” (ZIK-Directories and settings-Salary settings-General settings).

2. We activate “Keep records of sick leave, vacations...” (ZIK-Salary Settings-Payroll Calculation) so that you can calculate and withhold alimony automatically.

3. We work with the “Counterparties” directory. We determine the recipient based on the received sheet (Directories-Purchases and Sales-Counterparties-the “Create” button), fill in:

- Type of counterparty – Individual;

- Name – Semenova Zinaida Petrovna;

- Full name – filled in automatically.

In the group of details “Main bank account” we look for our credit institution, indicate the account number and other necessary values.

4. We include the credit organization PJSC Sberbank of Russia in our directory.

5. For alimony, a predetermined “Deduction by writ of execution” is used.

6. If, during the transfer, the employer will pay for the services of a paying agent (Russian Post or a credit organization) and deduct the amount spent on this from the salary, then you need to add “Paying agent remuneration” to the list of deductions (ZIK-Salary settings-Payroll calculation-Deductions-Create button "), fill in:

- Code – any value of your choice;

- Name/Category of Retention – select “Paying Agent Remuneration” or identical.

7. We create a new document “Writ of Execution”. It is available in the functional section “ZIK-Salary-Writs of Execution”.

Here we fill in:

- Organization (if information security keeps records for several organizations). For our example - LLC "Red Acacia";

- In the “Employee” field in the directory of the same name, we look for the person from whom the money is withheld - Petr Ivanovich Gerankin;

- In the “Recipient”, from the “Counterparties” we select their recipient - Semenova Zinaida Petrovna;

- The payment period in the “Withhold from/to” field is from 07/01/2018, we do not indicate the end date; Calculation method *: fixed amount, %, shares - we have 25%.

- “Comment” is filled out arbitrarily.

*Legislative limit on the considered deductions from wages is no more than 70%. There is no automatic control of the maximum amount of deductions in 1C, so you must manually control and track the maximum amount of deductions based on received sheets.

After filling in the data, click “File and close”.

8. We create a new “Salary accrual” (Salary - All accruals - “Create” button). Here, on the “Deductions” tab, data with the type “Deductions by executive documents” will be displayed.

After clicking “Fill”, the columns here will be filled as follows:

- “Employees” – employees for whom the documents “Writ of Execution” were entered – Petr Ivanovich Gerankin;

- “Type of operation” – according to the writ of execution;

- “Result” - the calculated amount of deduction - 25% of the official salary of Pyotr Ivanovich Gerankin is 4,350 rubles;

- “Recipient of the withholding” - the recipient counterparty from the list - Semenova Zinaida Petrovna;

- “Base” is our sheet, which served as the basis for deductions.

If the calculation of “%” or “Shares” is selected in the sheet, then in “Payroll” the amount of the deductions in question will be calculated automatically from the amounts of wages that were assigned to the employee upon hiring or personnel transfer (for example, the amount of salary). If accruals were added to the employee manually, for example, a quarterly bonus, then the amount of alimony will be automatically recalculated.

9. To deduct an agent’s remuneration, it must be calculated manually by adding it to the “Payroll”, on the “Deductions” tab, clicking the “Add” button. For our example, the size will be 4.35 rubles:

- On the “Holds” tab, click the “Add” button;

- In the “Employee” column, select “P.I. Gerankin” from an identical directory;

- In the “Retention” column – “Paying agent remuneration”;

- In the “Result” column, enter the number “4.35”;

- In the “Recipient” column of deductions, select “PJSC Sberbank of Russia” from the “Counterparties” directory;

- In the “Bases” column, select “P.I. Gerankin’s writ of execution.”

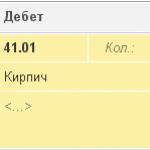

After filling out the “Payroll” document, save and post it. Postings will be made. To view the transactions, click on “Show transactions and other document movements.”

If the calculation and calculation of the amount of alimony is carried out manually, then the “Writ of Execution” does not apply. Manual mode is active when there is no “Keep records...” checkbox. You can add the calculated amount to our document by clicking the “Hold” button.

If the conditions of the writ of execution change, for example, the amount of the withholding percentage, the method of calculation is reduced, or the validity of the writ of execution is terminated, entering the conditions for the change in Accounting is not provided. Therefore, you need to make changes to the previously created document “Writ of Execution” or cancel (delete/mark for deletion) a previously created document and enter a new document “Writ of Execution”.

When the withholding ends completely, in 1C 8.3 Accounting it is necessary to cancel posting (mark for deletion/delete) the sheet or change the value of the end date of the withholding in the “Hold from/to” field.

There is no special document for accounting for alimony.

Let's look at how to properly execute this operation.

First, let’s create the “Alimony” accrual type. In the “Salary” menu, select the “Organization accruals” item. In the list of accruals, add a new accrual (by clicking the “Add” button):

- name - "Alimony";

- code - in order;

- reflected in accounting - select “Do not reflect in accounting”;

- Personal income tax - leave it blank;

- Insurance premiums - select “Income that is not subject to insurance premiums”;

- FSS (insurance from accidents) - select “Not taxed”;

- Type of accrual under Art. 255 TK - leave it blank;

- UST — select “Not subject to UST taxation”;

It should look like the picture:

Click “OK” and save the “Alimony” accrual.

In the “Salary” menu, select the item “Input information about planned accruals for employees of organizations.” Add a new document by clicking the “Add” button.

In the tabular part of the document, we select the employee from whom alimony must be withheld. In the “Accruals” column, select “Alimony”. In the “Action” column, set the value to “Start”. Next, we set the date from which the deduction of alimony from the employee’s salary begins and the amount of alimony with a minus sign.

It should look something like this:

Click “OK” and save the document. Let's move on to calculations.

In the “Salary” menu, open the “Wage accruals for employees of organizations” journal.

In the journal, by clicking the “Add” button, we create a new accrual document.

In the document, by clicking the “Fill” - “By planned accruals” button, we automatically fill out the tabular part:

As you can see in the figure, the employee’s salary and the amount of alimony with a minus sign were automatically entered into the tabular section:

Click “OK” and post the document.

To see the accounting entries, after accruing wages, you need to generate the document “Reflection of wages in regulated accounting.” It is filled out automatically, but the amounts of withheld alimony are not included in this document:

The posting of alimony withholding must be done manually using the document “Operations entered manually”:

If an employee of an organization is obliged to pay alimony, then, as a rule, the organization receives a writ of execution. An alimony payment agreement certified by a notary may also be presented. Let's look at how to draw up a writ of execution in 1C ZUP 8.3, as well as how to calculate and calculate alimony.

In order for “1C: Salary and Personnel Management 8.3” to automatically calculate alimony and deduct it from the employee’s salary, you must enter the appropriate one in the program. It can be created in the journal “Alimony and other deductions” or “Writs of Execution” (both of these journals are available in the “Salaries” section).

When filling out the document 1C ZUP “Writ of Execution” indicate:

- employee;

- holding period(if the end date for alimony payments is unknown, it does not need to be filled out);

- recipient(it should be created in the directory of counterparties and then selected) and its address;

- method of calculating alimony– a fixed amount, percentage or share (in the case of calculation by percentage, you need to choose from earnings or from the cost of living, and also indicate whether sick leave is taken into account in the calculation);

- do you need to stop holding? upon reaching a certain limit;

- Will the funds be transferred through a payment agent?(if yes, then it also needs to be entered into the directory of counterparties and selected);

- in case of using a payment agent– indicate at what tariff his remuneration will be calculated (the program already contains tariffs of Russian Post and Sberbank, if necessary, you can change them or add new ones).

Get 267 video lessons on 1C for free:

To indicate the details of the writ of execution that came to the organization, you need to click the link: “In printed forms it is displayed as “Writ of Execution”. The document details have not been specified...". After this, the link will take the form “Display in printed forms”. In the fields that open, you can select the type of document - a writ of execution or an agreement on the payment of alimony, and also enter its details - the number, when and by whom it was issued. Details are entered as text.

After filling out the document “Writ of Execution” you need to post it. The document allows you to print a card for recording executive documents.

If the conditions for collecting alimony have changed, you should enter and fill out another document called “Changing the conditions of the writ of execution.” It can be created on the basis of a previously entered writ of execution or directly in the journal “Alimony and other deductions”.

Calculation and accrual of alimony in 1C ZUP

After the program document “Writ of Execution” (or, if necessary, “Changing the terms of the writ of execution”) is completed and posted, the program will automatically, according to the specified conditions, calculate alimony and deduct it from the employee’s salary. These operations are performed by the document "".

Deductions under writs of execution, as well as remunerations of paying agents, are displayed on the “Deductions” tab.